Car Loan Interest Rate Malaysia 2018

New Used 7 - 9 years. This statistic shows the real interest rates in Malaysia from 2010 to 2020.

Malaysia Lending Interest Rate Data Chart Theglobaleconomy Com

Central Bank of India.

. This is a bad news for new car buyers which they will pay higher monthly payment for the Auto News. What are used car loan interest rates. New Used 9 years CIMB Hire Purchase-i.

Lenders have different interest rates set for used car loans which depend on a lot of factors such as the age of the vehicle loan tenure etc. KUALA LUMPUR April 23 The Association of Banks in Malaysia ABM today dismissed a call by National. Divided over a period of 84 months that comes down to.

Hire Purchase Fixed Rate Interest Rate. Affin Bank Conventional Hire Purchase. Daily interbank deposit rates and volumes of transactions according to tenure.

Learn More Apply Now. Get the best rates using our Malaysia Loan Calculator and apply for Car Loans. Bank Muamalat Hire Purchase-i.

Auto Financing Interest Profit Rate Car Condition Tenure Period Affin Bank Conventional Hire Purchase. New Used 9 years Public Bank Aitab Hire Purchase-i. If youve been planning to buy a car and apply for a car loan in Malaysia youll be well-advised to make the purchase before the Sales and Services Tax SST comes into force on September 1.

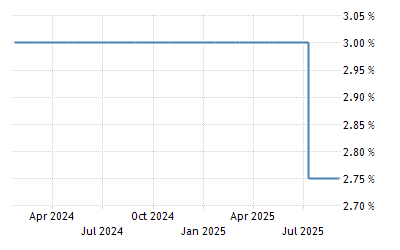

Car loan interest rate has been increased up to 4 for national car and 35 for non national car for loan period of 9 years. Its quick easy and convenient. Malaysia Bank Lending Rate - values historical data and charts - was last updated on April of 2022.

05 of loan amount Max. In 2020 the deposit interest rates by banks in Malaysia was at. RM1039920084 RM1238 per month.

All interest or profit rates amounts and terms are for reference only and not necessarily applicable to. Car prices are expected to increase and be higher than the GST price by approximately 2 to 3. Monthly Repayment in RM.

Current auto loan interest rates. 285 - 445 pa. Car Loan Interest Rates.

Bank of India Car Loan. Total interest over loan period. Whether it is a new car loan a used car or even a loan against a car HDFC Bank offers low-interest rates and flexible loan tenure on all its car loan products.

AmBank Arif Hire Purchase-i. In addition to this HDFC Bank car loans come with numerous benefits like fast. 025 of loan amount.

Bank Lending Rate in Malaysia is expected to be 348 percent by the end of this quarter according to Trading Economics global macro models and analysts expectations. In conjunction with the launch of Volvo Car Leasing all models will be offered with a special promotional rate that is applicable from today till August 31 2018. Car loan Banks.

The loan rates for shorter period also has been increased by local banks. Now added to your initial loan of RM84000 the total amount you need to repay is RM84000 RM1999200 RM10399200. CAR LOAN INTEREST RATE INCREASE IN MALAYSIA.

Hong Leong Mach Cruise Control Car Loan. 292 - 3 pa. 331 - 410 pa.

Get to know more about Pre-owned auto loans. In the United States the interest rate on five-year car loans increased slightly over time until it reached a highest value of 496 percent occurring in December 2018. New Used 9 years Maybank Hire Purchase.

340 - 425 pa. Nov 18 2021. HDFC Bank offers Car Loan to both salaried and self-employed persons based on their age income and employment experience.

For example You borrow RM 100000 vehicle loan for 7 years at 3. Interest Rate in Malaysia is expected to be 175 percent by the end of this quarter according to Trading Economics global macro models and analysts expectations. 13 15 2012 2013 alza auto bank car loan dealer discount diskaun executive finance financing free gifts full loan graduate scheme harga hari raya Honda Honda City Honda Civic honda dealer honda malaysia honda promotion interest interest rate kia loan malaysia manual mitsubishi myvi myvi 13 myvi 15 myvi se naza Naza forte nissan perodua.

Hong Leong Auto Loan. In the long-term the Malaysia Bank Lending Rate is projected to trend around 398 percent in 2023 and. Car Loan Interest Rates.

In Malaysia vehicle loan rate is calculated flat forward sum to the future. In Malaysia car loan interest rates differ based on several criteria which notably include the make and model of the car the age of the car new or second-hand the financial standing of the borrower the loan amount the repayment period as well as the entity providing the loan. Alliance Bank Hire Purchase.

In the long-term the Malaysia Interest Rate is projected to trend around 250 percent in 2023 and 300 percent in 2024 according to our econometric models. In the battle of reducing national car interest rate The Association of Banks in Malaysia ABM mentioned that the interest was set by individual commercial bankRead the full story from bernama below. BANKS DECIDE INTEREST RATE FOR CAR LOANS.

Please use this calculator as a guide only. EMI per Rs 1 lakh for 7 Years. Used car interest rates range from 361 percent to 1987 percent for most borrowers according to the most recent statistics from Experian.

In this case the effective interest rate EIR for this car loan is 627. Generally it is a good idea to make comparisons between. This may be a little bit too technical for some but definitely useful for those who really care about their money and has something to do with or going to have car loan.

Pin Oleh Wahyu Dwi Pambudi Di Share Link

0 Response to "Car Loan Interest Rate Malaysia 2018"

Post a Comment